Jones questions county budget, tax rate

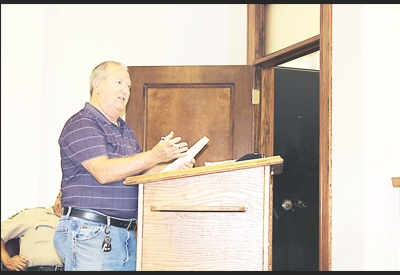

Photo by Britne Reeves

VZC resident Ronnie Jones spoke at the first public tax rate hearing Aug. 25.

During the first public hearing on the 2015-’16 proposed tax rate, Ronnie Jones spoke to commissioners concerning the proposed budget and tax rate.

The proposed tax rate is $0.485847 per $100 valuation which is the same as last year’s tax rate.

The effective tax rate is $0.47173823 per $100 valuation.

The rollback rate is $.48586097 per $100 valuation.

Jones asked commissioners for transparency regarding funding for capital murder trials.

Jones stated that the commissioners had proposed a budget with “nothing for capital murder trials” for the fiscal year and wanted to know “where the extra money was going if not to capital murder trials.”

Jones also asked for clarity on the budget and told commissioners that the “public needs to know exactly where the funds were going.”

Jones explained that the 2.5 cent tax rate increase in 2013 was “due to capital murder trials.”

Jones suggested that if the county is not budgeting for capital murder trials that the “the commissioners lower the tax rate down by 2.5 cents.”

To read the full article, subscribe to the Canton Herald or pick up a copy from one of our vendors.